Utah Car Sales Tax Out Of State

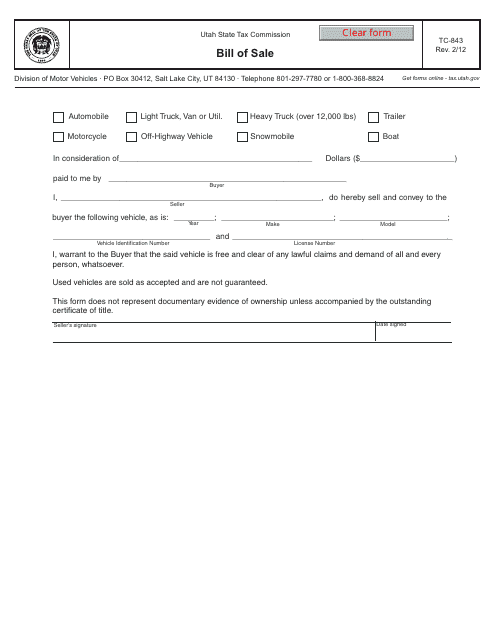

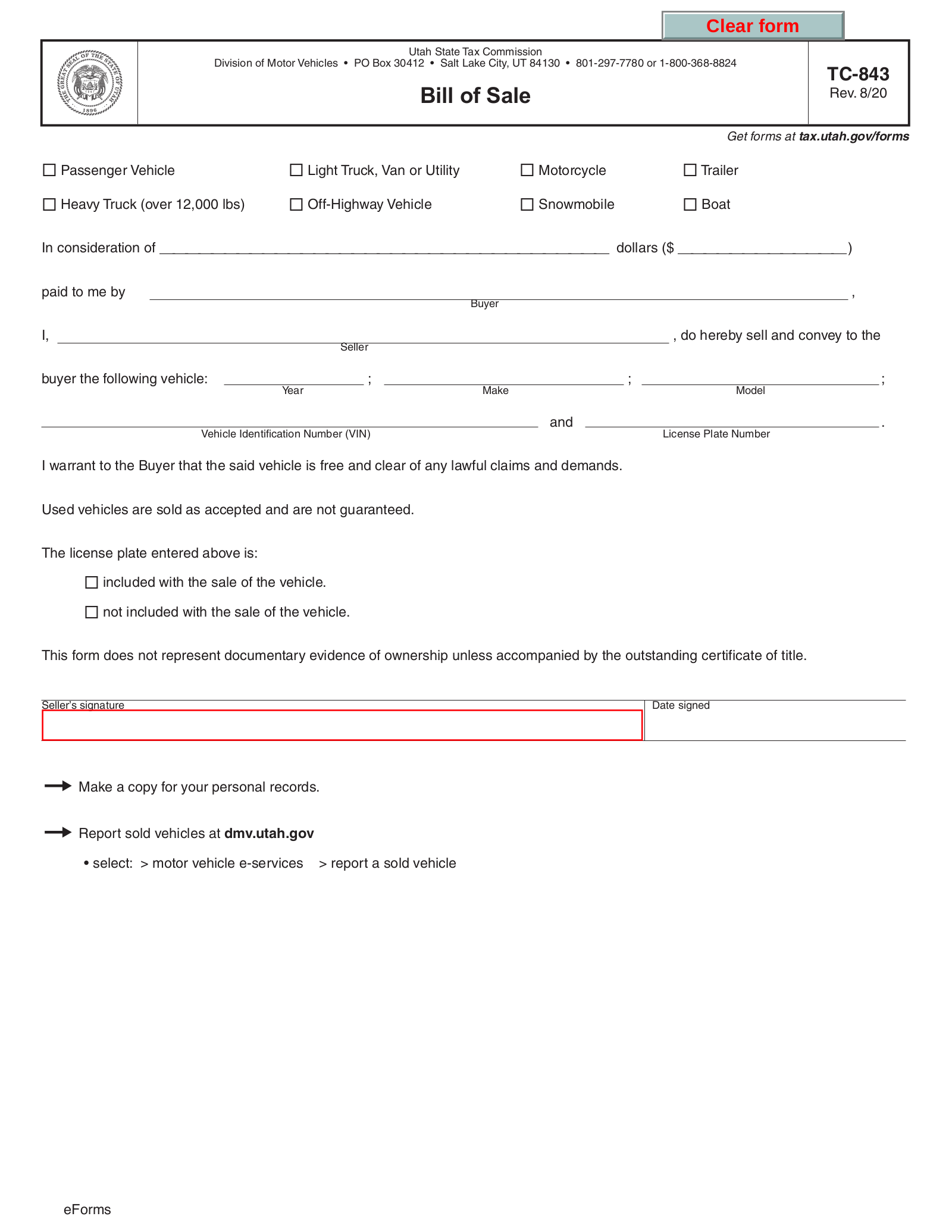

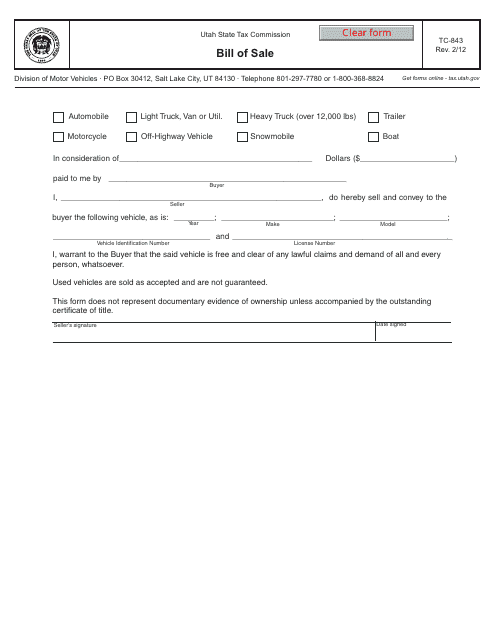

All dealerships may also charge a dealer documentation fee. If the purchaser of the vehicle obtains a signed bill of sale from the seller of the vehicle the amount of sales andor use tax to be collected will be based upon the net purchase price shown on the bill of sale if it contains the information described above.

The Best States To Retire For Taxes Smartasset Com Retirement Income Tax Brackets Inheritance Tax

The various taxes and fees assessed by the DMV include but are.

Utah car sales tax out of state. Nexus Filers below must have a Utah Sales Tax License. However if a commercial vehicle is brought into the state by a business that operates outside of Washington for temporary no more than 180 days in any consecutive 365 days business use then use tax is determined on the reasonable rental value. In addition car taxes between states vary widely.

If you have already paid Washington sales or use tax on the. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. If the vehicle is leased make sure the lessor has provided their power of attorney a billing statement and their Utah sales tax number.

Utah collects a 685 state sales tax rate on the purchase of all vehicles. Utah residents who are members of the US. They also state that the average combined sales tax rate of each zip code is 6775 percent.

The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. You can apply for a license online at taputahgov Tax Commission only or osbrutahgov multiple Utah agen-cies or by submitting form TC-69 Utah State Business and Tax Registration Tax Commission only. According to Sales Tax States 61 of Utahs 255 cities or 23922 percent charge a city sales tax.

However non-resident military personnel who purchase a vehicle in Utah must pay the salesuse tax on the vehicle if they plan to operate the vehicle in Utah. However there are some services which are taxed for example services which include repairs renovations or installation laundry services or dry cleaning services. They fedexed me all the signing and temp registration documents a few days ahead I signed them and sent them back.

Surplus Vehicles Inventory - Utah Surplus Property Auctions. Calculating Sales Tax Without a Bill of Sale. Utah Resident Service Members Stationed Outside of Utah.

In addition to taxes car purchases in Utah may be subject to other fees like registration title and plate fees. Prices are subject to verification. The state of Utah does not usually collect sales taxes on the vast majority of services performed.

See RCW 8212010 7 c. It does not contain all motor vehicle laws or rules. MakeType Year Model Style Identification number Purchaser Dealer.

You should not collect local sales tax on out-of-state orders in most states. When a vehicle is purchased out of state by an enrolled tribal member and driven into Utah within a reservation boundary the purchase is not subject to tax. Some images may be multiple inventory items with each having an individual price.

Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800-662-4335. Whether you must charge your customers out-of-state sales taxes comes down to whether youre operating in an origin-based sales tax state or a destination-based sales tax state. If you buy a car in another state there is no guarantee you can register it in your home state even if you have already paid for the vehicle and all associated taxes.

As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door neighbor Massachusetts has a state. Updated April 08 2021. The full amount of Nevada sales tax is due on vehicles purchased in Utah regardless of any statement on the contract.

Tax rates may change quarterly. The process of determining which tax rates apply to individual purchases is referred to as sales tax sourcing and it can be somewhat. Some dealerships may also charge a dealer documentation fee of 149 dollars.

You would generally collect your own states sales tax on orders placed from within your own state or delivered there. Utah dealers do not pay sales tax to Utah on out-of-state vehicle sales. Utah State Tax Commission 210 N 1950 W Salt Lake City UT 84134 wwwtaxutahgov Sales and Use Tax Exemption Affidavit for Exclusive Use Outside of Utah This sales tax exemption may be allowed only if all names and addresses are complete and this form is signed.

In Utah Salt Lake County collects a 725 state sales tax rate on the purchase of all vehicles. My tax rate was 675 matching the Utah County tax rate where I live 685 is generally the rate in Salt Lake county unless a particular city has additional taxes. Picks up the item in Massachusetts.

This website is provided for general guidance only. Calculating Sales Tax With a Bill of Sale. Component s MUST sell with vehicle.

Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. When a vehicle is purchased out of state by an enrolled tribal member and driven into Utah outside the tribal boundary on its way to the reservation the purchase is subject to tax. Sales tax is due even if they choose to register the vehicle in their home state.

I honestly preferred the out-of-state purchase. Nonresident purchaser may continue to qualify for sales tax exemption for vehicles purchased in Utah if the vehicle off-highway vehicle boatboat trailer or outboard motor is used in this state infrequently occasionally and for nonbusiness purposesThe use of a boat boat trailer oroutboard motor cannot exceed 14 days within a calendar yearThe restrictions on use do not apply to nonresidents who use the purchasedvehicle only to commute to a trade profession or occupation in Utah. In addition to taxes car purchases in Utah may be subject to other fees like registration title and plate.

For example Massachusetts charges its sales tax when the purchaser does any of the following. Often however they will indicate the estimated amount of Nevada sales tax due as taxes paid to Utah.

Can You Help Me Understand This Insurance Better Insurance Quotes Health Insurance Quote Car Insurance

Buy A New Car In Utah Southtowne Automall

2021 Black Series Caravan Hq 17 Travel Trailers Rv For Sale In American Fork Utah Rvt Com 174744 Rv For Sale Black Series American Fork

Click To See More M998 America Murica H1 Hmmwv Humvee Hummer Militaryhummer H1 Army Military Offroad 4x4 Superc Hummer Hummer H1 Hummer Cars

1955 Hudson Rambler Deluxe Club Sedan Rambler Sedan Car Ads

Velodyne Which Makes Lidar Used By Uber Comments On Fatal Crash Self Driving Crash Uber

Utah Generic Bill Of Sale Download Printable Pdf Templateroller

When You Meet Someone Treat Them As If They Were In Serious Trouble And You Will Be Right More Than Half The Time Just Wanted To Post A Reminder Tonight I

Pin By Keijo On Favorite Cars Triumph Spitfire Triumph Cars Triumph

Pontiac 1946 Car Ads Vintage Cars Pontiac

Free Utah Bill Of Sale Forms Pdf

Free Utah Motor Vehicle Bill Of Sale Form Tc 843 Pdf Eforms

Sales Tax On Cars And Vehicles In Utah

Utah Sales Tax On Cars Everything You Need To Know

Buy A New Car In Utah Southtowne Automall

Utah Bill Of Sale Automobile Trailer Boat Download Fillable Pdf Templateroller

Post a Comment for "Utah Car Sales Tax Out Of State"